If you are keen on a monthly informational newsletter on the latest New Launches projects in Singapore, do sign up for our newsletter.

We have a strict no spam policy and we only send 1 newsletter every month.

If you are keen on a monthly informational newsletter on the latest New Launches projects in Singapore, do sign up for our newsletter.

We have a strict no spam policy and we only send 1 newsletter every month.

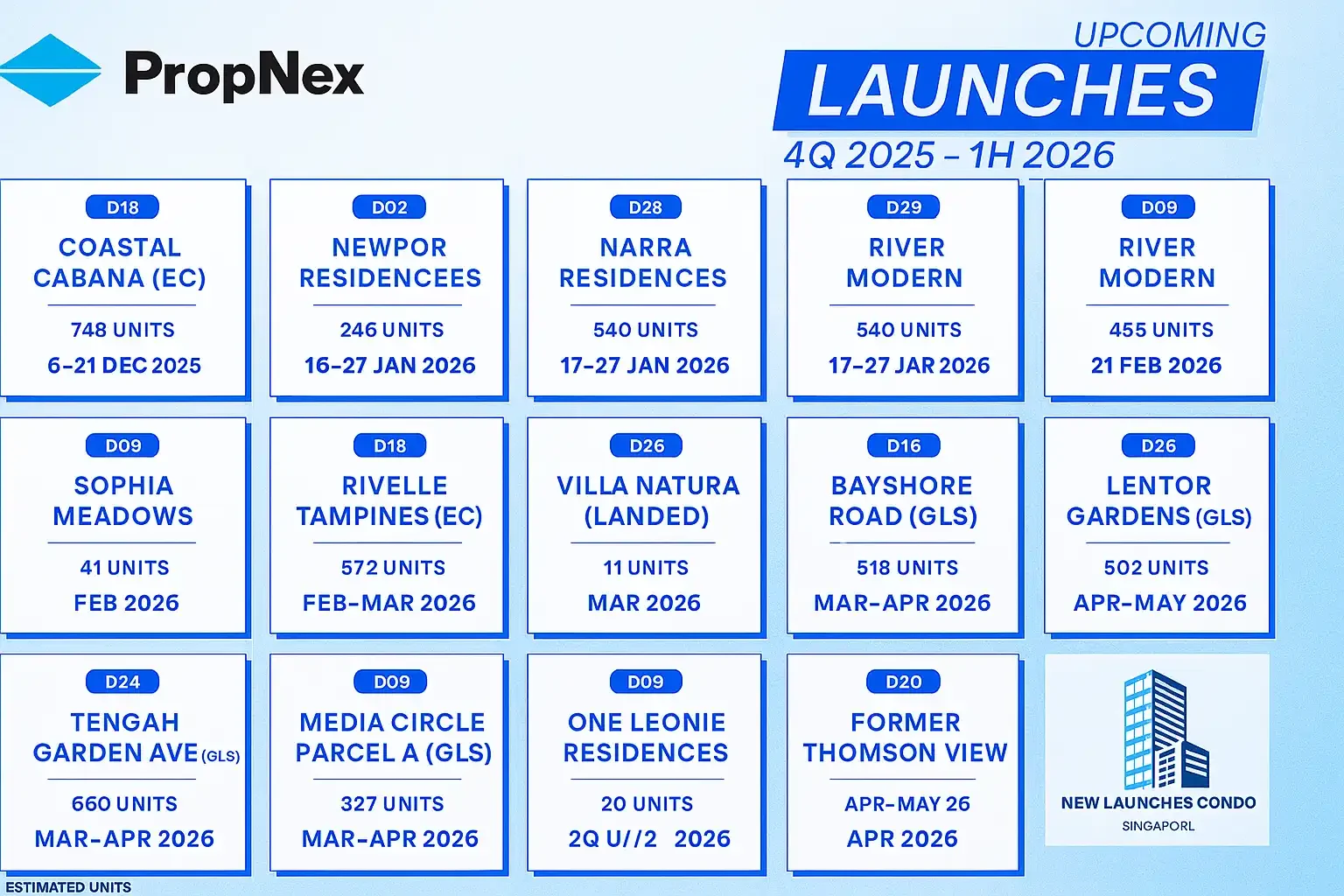

A quick guide to the next wave of new condo launches in Singapore — including ECs and GLS plots — with preview windows from the latest market brief. Short notes below; I’ll keep this page updated as more details surface.

A large executive condominium in the Pasir Ris/Tampines corridor with an estimated 748 units, Coastal Cabana (EC) targets family buyers who want condo facilities plus EC entry pricing. Expect good access to the East via PIE/TPE, proximity to Tampines and Pasir Ris malls, and coastal recreation along Pasir Ris Park. With upgraders in mind, typical EC layouts include spacious 3- and 4-bedroom options and full suites of amenities. Interested in eligibility and MSR considerations for ECs? WhatsApp +65 8866 9422.

A city-core release in the Tanjong Pagar district with around 246 units, Newport Residences will appeal to CBD professionals and investors seeking downtown accessibility, Grade-A amenities, and proximity to Tanjong Pagar, Prince Edward, and future GSW (Greater Southern Waterfront) catalysts. Expect premium specifications, efficient 1–3 bedroom mixes, and strong rental demand from the office and port-redevelopment catchment.

Positioned near Dairy Farm/Bukit Panjang, Narra Residences brings about 540 units to a green, low-density enclave with fast links to BKE/PIE and Hillview & Cashew MRTs. Buyer appeal: nature-side living (Dairy Farm Nature Park, Bukit Timah Reserve), reputable schools, and modern family-friendly facilities. Perfect for those who value tranquillity and green views.

A District 9 boutique-scale launch of about 455 units in the prime Orchard/River Valley belt, River Modern targets buyers who want a central address with lifestyle proximity to the Singapore River, Great World, and Orchard retail cluster. Expect efficient 1–3 bedroom investor units alongside family-sized layouts, strong MRT access, and a premium facilities stack designed for city living.

Tucked off Mount Sophia in prime District 9, Sophia Meadows is a low-density 41-unit freehold-style experience with a quieter hilltop feel minutes from Dhoby Ghaut interchanges and the Orchard–Bras Basah cultural belt. Ideal for owner-occupiers seeking calm and connectivity.

With approximately 572 units, Rivelle Tampines (EC) rides on the strength of Tampines Regional Centre and Tampines North growth. Expect comprehensive facilities, family-friendly stacks, and convenient access to major expressways and the Tampines/Pasir Ris amenity cluster.

An exclusive 11-unit landed release in the Upper Thomson/Lentor vicinity, Vila Natura draws multi-generational families seeking privacy, green surroundings, and proximity to Lentor’s growing lifestyle cluster. Expect clean architectural lines, practical layouts, and a sense of community amid nature.

A mid-to-large condominium of about 588 units* in the East, Pinery Residences will appeal to upgrader families looking for value near established schools, parks, and retail nodes across Tampines and Pasir Ris. Anticipate a resort-style facilities deck and a wide mix of bedroom types.

A major GLS plot in the emerging West with an estimated 860 units*, positioned to serve buyers who want a nature-centric master-planned town with new amenities and transport links. Expect strong interest from first-timers and upgraders eyeing long-term growth in the Tengah–Jurong region.

Serving the one-north/Media Circle ecosystem, this GLS site is slated for around 327 units*. Expect tenant demand from tech and media clusters, great access to Buona Vista/one-north MRTs, and lifestyle convenience around Rochester and Star Vista. A strong watchlist pick for investors.

Estimated 518 units* in the Bayshore precinct, which is earmarked for a vibrant new residential district. Expect East-side lifestyle perks, proximity to coastal parks, and future Thompson-East Coast Line connectivity that enhances liveability and rental value.

Part of the growing Lentor private-home cluster, the Lentor Gardens GLS site (about 502 units*) benefits from Lentor MRT, new retail amenities, and adjacency to green corridors. Families seeking reputable schools in the larger Thomson–Ang Mo Kio area should keep tabs on unit mix and facing selection here.

An ultra-limited ~16-unit* boutique at Mount Emily, pairing a quiet heritage pocket with swift access to Dhoby Ghaut, Bugis–Bras Basah arts nodes, and Orchard. Expect collectable layouts for owner-occupiers who value privacy and prime-core convenience.

A rare, low-density ~25-unit* project off Leonie Hill, offering a serene District 9 address steps from Orchard and River Valley. Anticipate larger formats, premium specs, and strong appeal to owner-occupiers seeking exclusivity in the core central area.

A major redevelopment in the Thomson/Bright Hill precinct with an estimated ~1,240 units*. Former Thomson View offers excellent connectivity to Upper Thomson and Bright Hill MRTs, nearby parks and reservoirs, and well-regarded schools. Expect multiple towers with a wide unit mix appealing to families and investors alike.

Like early access to floor plans, stack analysis, and first-hand price guides for these Singapore new launches? Message +65 8866 9422 on WhatsApp and I’ll send the latest info the moment it’s released.

*Estimated units and timelines. Subject to change pending final approvals and developer announcements.